Cofactor is somewhat unique compared to a traditional biotech due in large part to it having its roots in service. These roots meant that we had to do little in terms of a funding raise (we did just a friends and family raise) before we were cash flow positive and generating revenue shortly after opening our doors. Since our founding, we’ve taken that initial friends and family capital raise and generated more than 60X that in revenue to date. Interactions with our clients and the industry as a whole throughout that time have been very helpful in identifying key products that are needed in the market, and we are poised to bring them to market. This is going to take a raise in capital (for which we are 50% along that path in accomplishing).

As a result, I’ve been talking to VCs the last 3 months, and below represents one of the most important things I have learned and how I have had to completely reverse my thinking.

The academic mindset

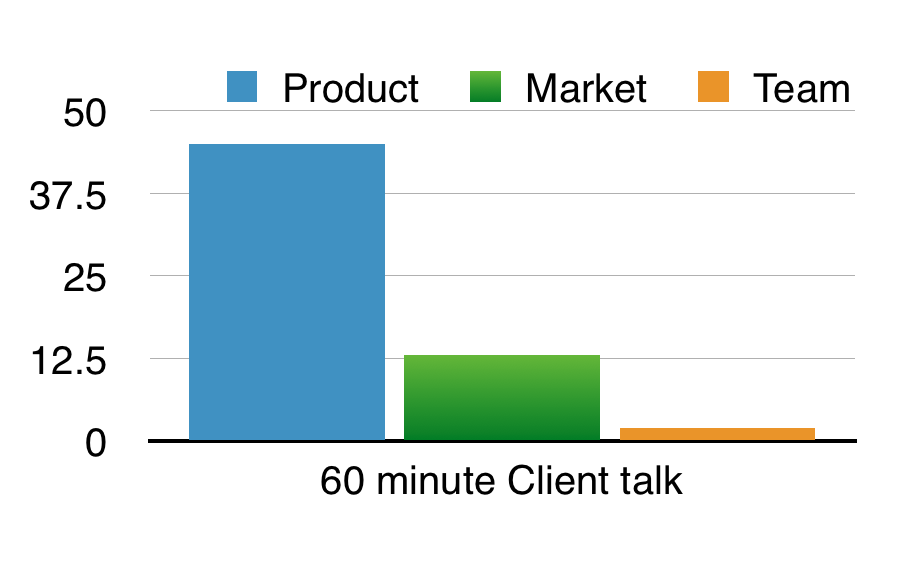

The charts show levels of importance and therefore minutes attributed in a talk. Both through my academic career and how we have largely thought of things in business up to now, the following rings true:

Product = This takes center stage. It is all about features and what those features can do to solve the problem I am addressing.

Market = If I am trying a new approach, so new that a market does not even exist yet, then this is even better. I will have the jump on my competitors and colleagues.

Team = Who is the team that brought that approach to market or published that technique? Half the time I might remember, half the time not, it is really inconsequential. It is usually considered poor form and braggadocio to spend too much on the team really.

The VC mindset

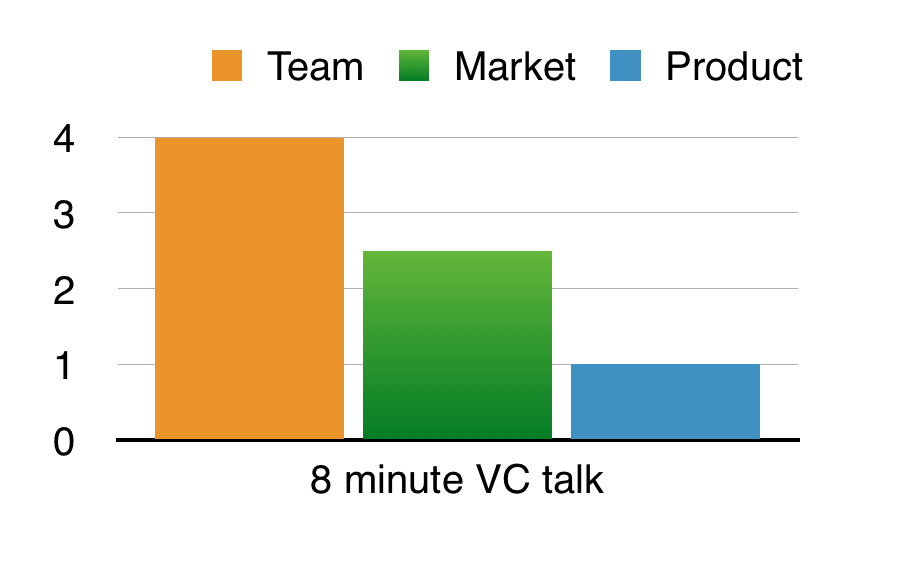

From the banker’s or VC’s perspective, though, this is how it should look:

Team = This now takes center stage. A team that can execute is the most important factor.

Market = How big is the pie and who has already taken other parts of the pie? This is rarely a topic in a client presentation (but maybe it should be).

Product = Some VC talks don’t even have time to discuss the product. If competency can be established in the other two, there is faith that what is being proposed is just a V1 anyway and it is too technical to really dig into those details of the product.

Conclusion

Although the title “Unlearning the PhD” might hint at dumbing down a talk, that is not the point of this post… actually quite the opposite. Both the focus and the length of a talk greatly differ between a VC talk when compared to a research or client meeting. In fact if you look at them they are essentially the opposite in focus and length of time.

I would argue that there is a significant amount to be learned from a VC talk approach that could be adopted in client-facing talks and company messaging. Specifically, there is a need to cut these talks down from 1 hour to 20 minutes (at most). There is an opportunity to highlight the team and the market, prior to discussing the product, which will significantly put the product in perspective. Lastly, there is a tendency to not talk about or acknowledge competitors in a product or client talk, and this is a real missed opportunity to highlight how your product is addressing key hurdles that your clients may not be addressing.

Stay tuned to see how successful I have been in unlearning my PhD in future posts.